Quick payroll calculator

Save 600 On Average. Payroll So Easy You Can Set It Up Run It Yourself.

Square Payroll Vs Quickbooks Payroll Which Is Best Why

It will confirm the deductions you include on your.

. No api key found. Double check your calculations for hourly employees or make sure your salaried employees get the right take. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. 2Enter the Hourly rate without the dollar sign. It only takes a few seconds to.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. Small Business Low-Priced Payroll Service.

Get Your Quote Today with SurePayroll. Ad Get Started Today with 2 Months Free. Important Note on Calculator.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. All Services Backed by Tax Guarantee. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Free 30 Day Trial. Compare Plans And Save Today.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Total annual income - Adjustments Adjusted gross income Step 3. This number is the gross pay per pay period.

Ad Process Payroll Faster Easier With ADP Payroll. Theyre also rigorously tested for pinpoint accuracy. This number is the gross pay per pay period.

Sign Up Now before deadline. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Well Do The Work For You.

Here When it Matters Most. Tax Code 1257L is the most. Quick Pay Calculator Quick Pay Calculator for 202122 Change to Previous Tax Year For an estimate of your take-home pay please fill in your salary below.

Discover ADP Payroll Benefits Insurance Time Talent HR More. If you need a little extra help running payroll our calculators are here to help. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. How to use a Payroll Online.

So benefit estimates made by the Quick Calculator are rough. For example if an employee makes 25 per hour and. Then multiply that number by the total number of weeks in a year 52.

Ad Fast Easy AffordablePayroll ServicesFor Small Business. Important Note on Calculator. Hourly Paycheck Calculator Loading calculator.

As an employer youre. Enter your info to see your. Self And Full Service Payroll Options.

How do I figure out how much my paycheck will be. Ad Process Payroll Faster Easier With ADP Payroll. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Subtract any deductions and. Make YourPayrollEffortless and Focus on What really Matters. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Customized Payroll Solutions to Suit Your Needs. Computes federal and state tax withholding for. Get Started With ADP Payroll.

Starting as Low as 6Month. Household Payroll And Nanny Taxes Done Easy. All our hourly payroll calculators are based on a constantly updated tax database.

Ad Calculate And Run Your First Payroll In As Little As An Hour. Multiply the hourly wage by the number of hours worked per week. A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec.

Print our hourly wage calculator A new. Find out if you are eligible. Select a State Annual Wage.

Ad Business with payroll can receive an avg of 144300 through the this ERTC Tax Credit. 1Use Up Arrow or Down Arrow to choose between AM and PM. Get 3 Months FreePayroll.

Step 1 - Determine your filing status Step 2. All our payroll calculators can account for personalized. No Hidden Fees Upfront Costs.

Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Subtract any deductions and. 3 Months Free Trial.

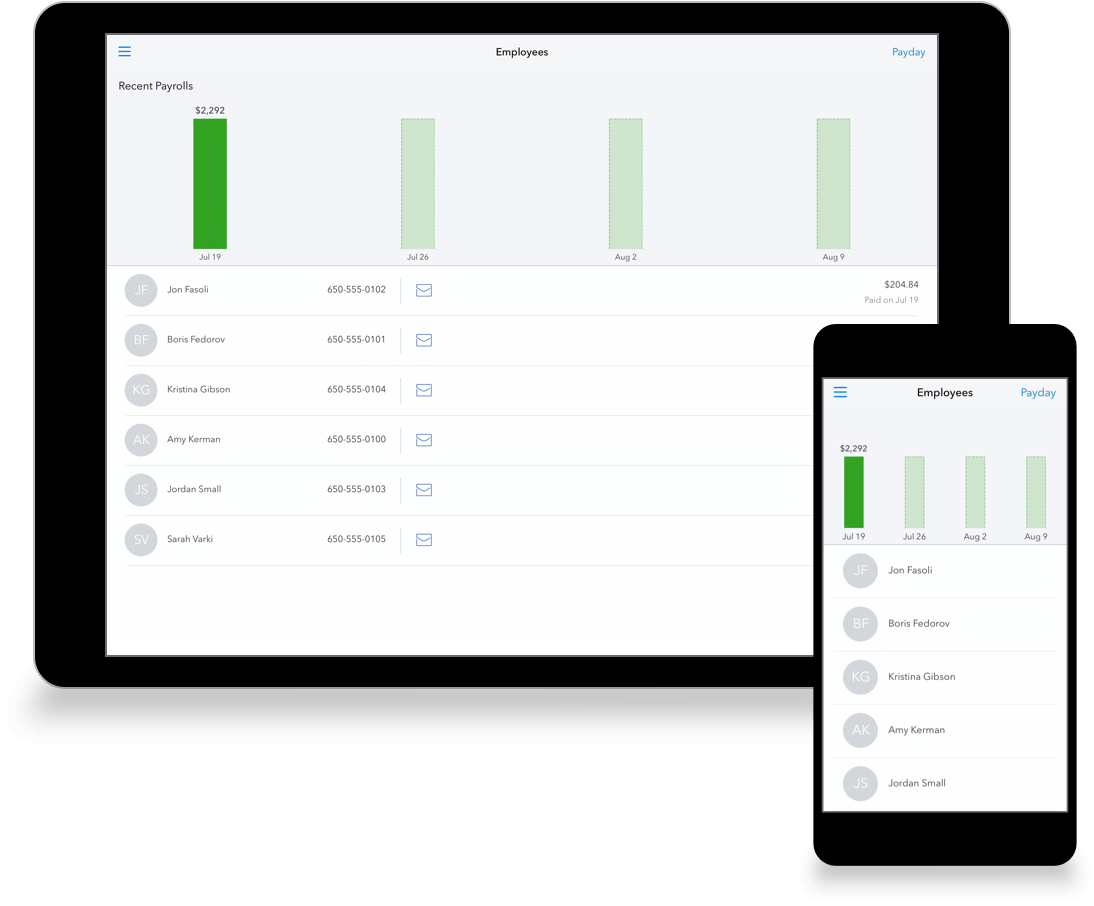

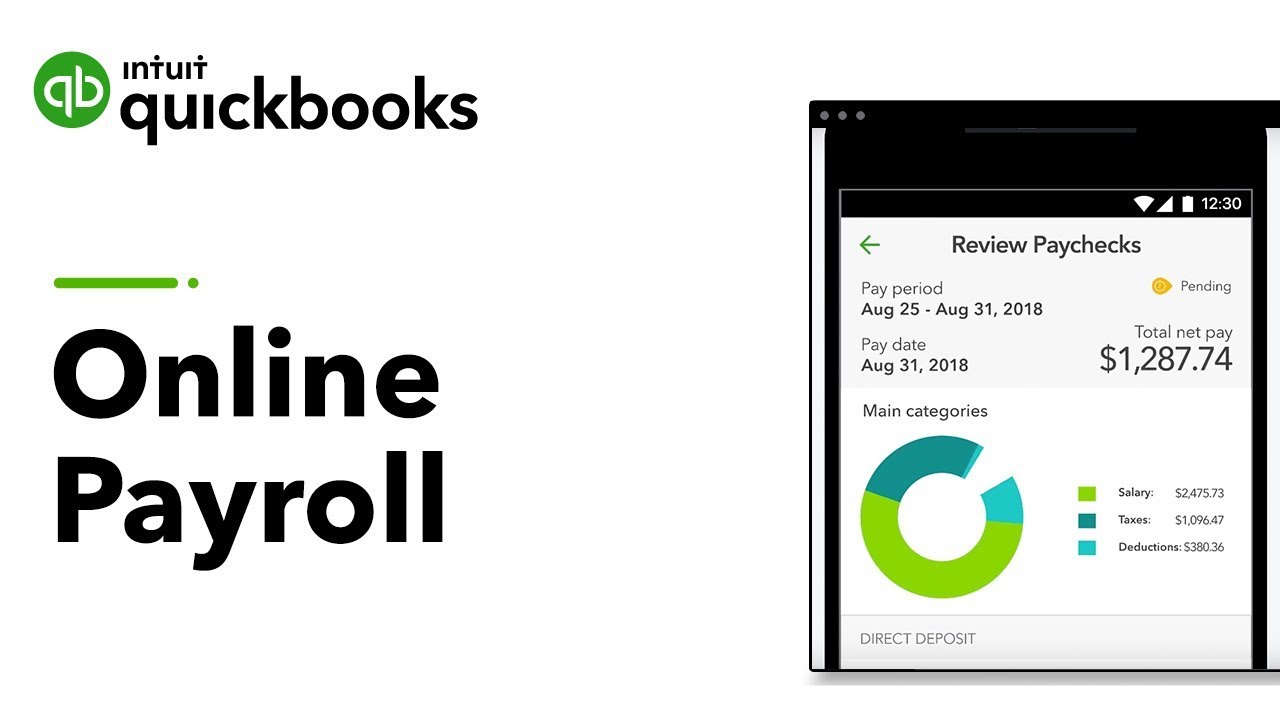

Payroll App For Small Business Run Payroll From Mobile With Quickbooks

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

Hourly Cost Calculator In Quickbooks Online Projects Youtube

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

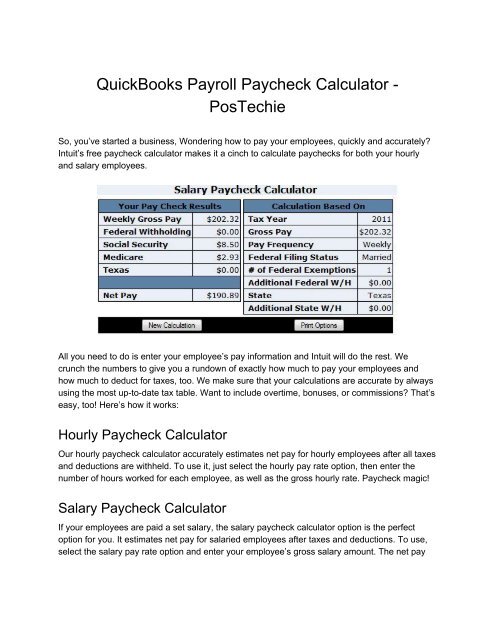

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

One Day Processing Now Available For Quickbooks Payroll

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How A Payroll System Works

Your Easy Guide To Payroll Deductions Quickbooks Canada

Avanti Income Tax Calculator

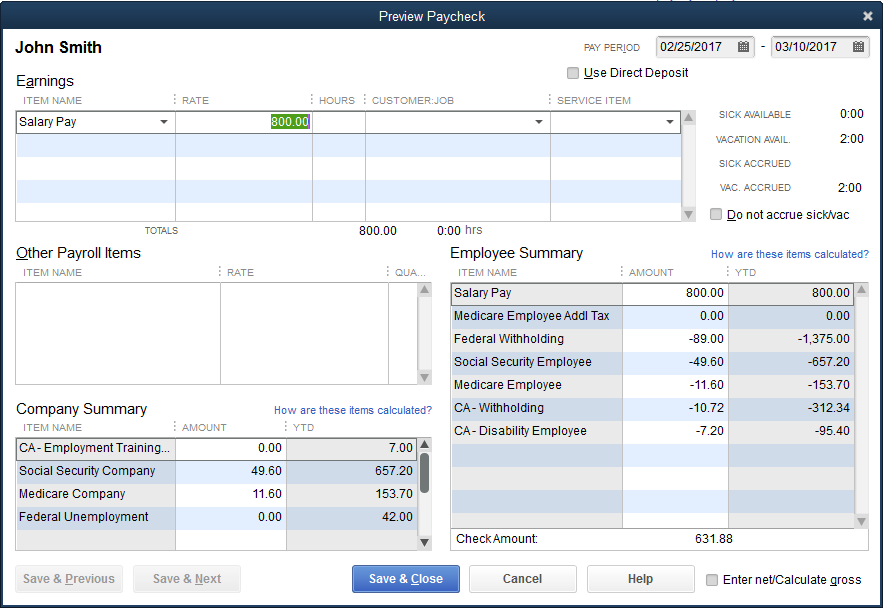

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

Payroll Calc Outlet 55 Off Www Wtashows Com

Payroll Errors Most Common Quickbooks Accounting Mistakes

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Connect Quickbooks Payroll Hr Benefits With Quickbooks Online Intuit

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp