Mortgage borrowing ratio

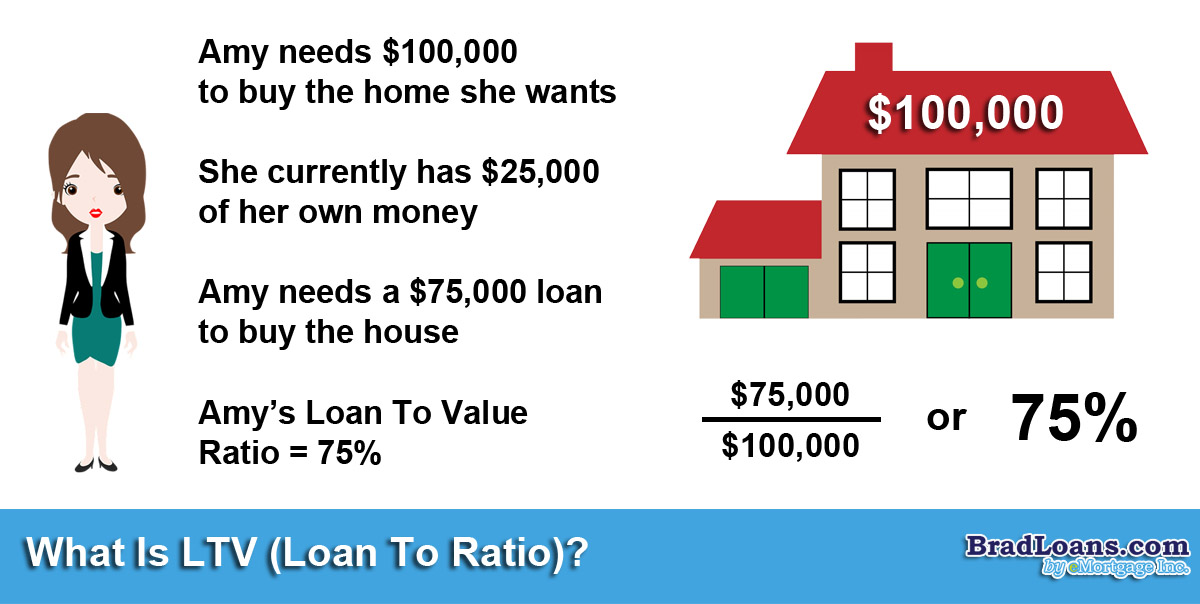

Loan-to-Value Ratio Amount of Mortgage Property Value Lets say the bank decides to lend 70000 to the borrower. The borrowers front-end ratio which is the total housing expense compared to the.

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

Learn More Apply Today.

. The debt ratio is defined as the ratio of total debt to total assets. The more you put toward a down payment the lower your LTV. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

Ad Home Financing Home Loans for Vermonters. Compare Offers Side by Side with LendingTree. According to the above formula it will be a 70 LTV.

Learn More Apply Today. A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. For homebuyers who are trying to qualify for an FHA loan an acceptable loan-to-value ratio is 965 if your credit score is at least 580.

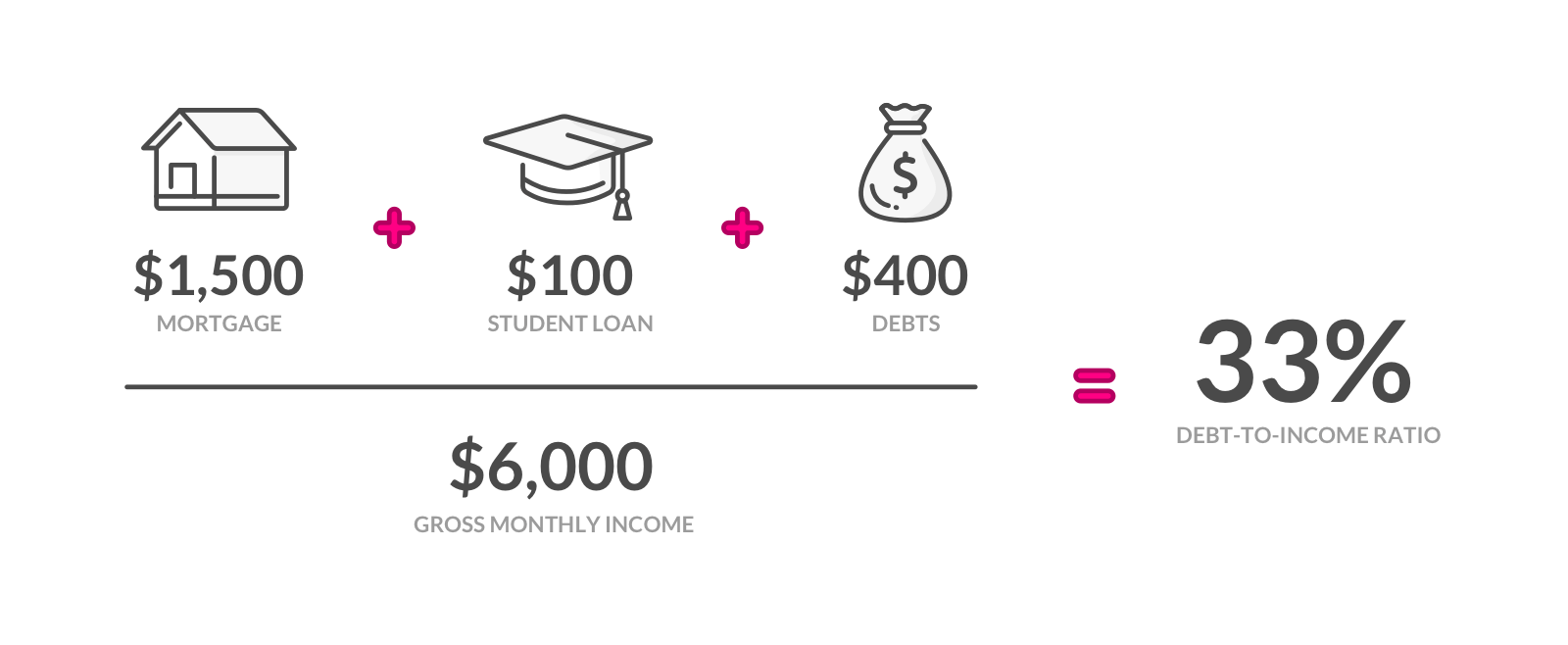

Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property expressed as a percentage. The calculator will give your current loan-to-value ratio the percentage of your homes value that you owe to your mortgage lender and whether you might qualify for a HELOC or need to.

Total Borrowing Ratio Total Borrowing Ratio Measures the ratio between debts and total assets of a company. Loan-to-value LTV ratio This ratio compares the amount you hope to borrow with how much the property is worth. Your debt-to-income ratio is a metric that your loan officer will use.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Get the Right Housing Loan for Your Needs. A set of ratios that are used by lenders to approve borrowers for a mortgage.

Debt-To-Income Ratio - DTI. What More Could You Need. For example if you buy a home appraised at.

Ad Were Americas Largest Mortgage Lender. Take Advantage And Lock In A Great Rate. Ad Compare Your Best Mortgage Loans View Rates.

Make Change Simply by Banking. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. A Credit Union for All Vermonters.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. Staff also recommends the Plan reflect a maximum Covenant Borrowing. Ad Home Financing Home Loans for Vermonters.

Lender Mortgage Rates Have Been At Historic Lows. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Typically the higher your deposit the lower your LTV.

If your credit score falls between 500. A Credit Union for All Vermonters. Lock Your Mortgage Rate Today.

Make Change Simply by Banking. For example if your monthly pre-tax income is.

Debt To Income Ratio Formula Calculator Excel Template

Mortgage Ratios It S Not As Difficult As You Think Achroma

How To Calculate Your Debt To Income Ratio Lendingtree

What Is The Debt To Income Ratio Learn More Citizens Bank

What Is Ltv Loan To Value Ratio Brad Loans By Emortgage

Loan To Value Ratio Prepnuggets

/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

:max_bytes(150000):strip_icc()/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

How To Calculate Your Loan To Value Ratio Finder Com

Loan To Value Ratio Ltv Formula And Example Calculation

Debt To Income Dti Ratio What S Good And How To Calculate It

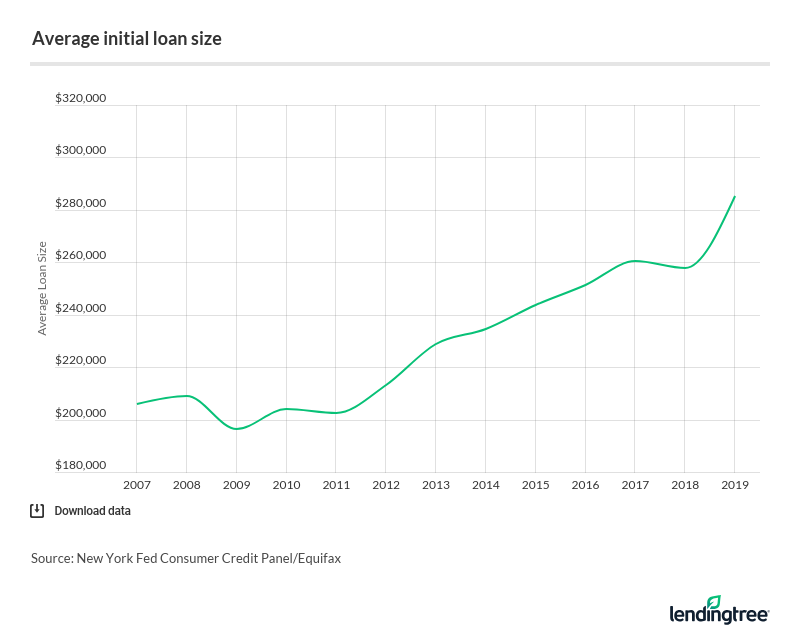

U S Mortgage Market Statistics 2020

Fha Requirements Debt Guidelines

Mortgage How Much Can You Borrow Wells Fargo

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Ltv What Is Loan To Value Ratio Zillow